Probate

Probate Law in Florida

Do you need to Probate an estate in Florida?

We offer affordable fees based on the specifics of each estate. Call our office today to speak with one our probate assistants or to schedule a consultation!

Affordable Attorney, Gerling Law Group is available to provide you with legal counseling and guidance as we walk you through the probate process. We understand that losing a loved one is one of the hardest things one endures in life. As a Personal representative or Trustee of an estate you have been entrusted to carry out your loved one’s wishes and to protect their assets for their beneficiaries. As a fiduciary, you must adhere to certain legal requirements and duties. Let us help take some of the responsibility and assist in handling your loved one’s estate and affairs to ensure it is handled properly and timely.

We accept probate cases in any county in Florida. The personal representative can live anywhere in the United States.

“To have been loved so deeply, even though the person who loved us is gone,

will give us some protection forever” –J.K. Rowling

We are available to answer all of your questions:

- What is Probate and does it apply to my case?

- Has someone you know passed away owning assets or owing debt?

- Are you asking yourself what needs to be done to settle the estate?

- Are you familiar with the Probate laws and requirements of Florida?

- Is there real estate to sell? How does the homestead law apply?

- Do you know what needs to be done with Florida and Federal Taxes?

- What are the fees involved with Florida Probate?

- What happens when the bills come in?

What can we learn about estate planning from the rich and famous?

There are many estate planning lessons to be learned from the recent celebrity deaths. Many celebrity wills are available to the general public on the internet. The rich and famous seem to use Trusts in their planning, which for reasons other than wealth, allow them privacy in the administration of their Estate Plans. As we have seen, we are easily able to access celebrities’ Wills in the age of the internet by just looking online. Michael Jackson’s Will can be found at TMZ. These documents can be used as valuable teaching tools to illustrate common estate planning do’s and don’ts.

If you look at Michael Jackson’s Will you will be able to learn several key factors about his Estate Plan. His will is a Pour-Over Will, which requires that all assets not already held in a Trust will be transferred into a trust upon his death. As stated in Jackson’s Will, his assets will be transferred to the “MICHAEL JACKSON FAMILY TRUST” as amended and restated on March 22, 2002. The language “as amended and restated” simply means he had a prior Trust that he has completely changed. The terms of his revocable trust will govern the disposition of his property. It can be assumed that the majority of assets will remain in trust for his children and future grandchildren while the remaining assets will likely be distributed to other relatives and charities. Jackson’s mother is named successor Guardian, with Diana Ross as a second option if his mother is unable to carry out her duties. This is an example of how a good estate plan can help to ensure that your wishes are met by offering the court a clear picture of how you want your affairs handled. In Michael Jackson’s case, the question debated in the media is whether the children’s mother should be named guardian. This sort of ambiguity should always be explicitly defined in estate planning documents so that these decisions will not be left up to the court. You should always update your Estate Plan to ensure that it reflects your current situation.

Another celebrity who passed away recently is Michael Crichton, author of Jurassic Park and producer of the television show “ER”. The major complication in his case is that he had been married five times and in the most recent marriage left a prenuptial agreement, a living trust, and many unanswered questions. Crichton’s Trust, entitled the “John Michael Crichton Trust dated May 1998”, omits his children and has been amended three times. Because of the privacy that a Trust typically allows, we do not know the size of the trust or the beneficiaries. To further complicate the matter, his surviving spouse, Sherri Alexander Crichton, was pregnant at the time of her husband’s death. The unborn child likely has a statutory claim to the father’s estate, allotting Mrs. Crichton a larger percentage of the total estate as the minor child’s Guardian. Crichton’s Will was filed in California; however, if it had been filed in Florida, the baby and its mother might both have claims to the estate. A spouse in the state of Florida is automatically entitled to an Elective Share of the estate along with a life estate in the decedent’s homestead real property. In a valid prenuptial agreement, a spouse can waive those rights, but the surviving spouse’s attorney will be carefully reviewing the agreement with regard to its validity.

The rich and famous are not that different from the rest of us. They may live their lives with more grandeur, but in the end, they are held to the same standards when it comes to disbursing their estates. Everyone should have an estate plan that is kept up to date when significant life changes occur. These changes can include marriage, the birth of a child or grandchild, receipt of an inheritance, illness, change in place of residence, or death of a child or spouse. There is a variety of estate planning documents available to you. We can help you with all of your estate planning needs, and remember – you don’t need to be a celebrity to plan for your future.

Probate Law: The Florida Probate Process

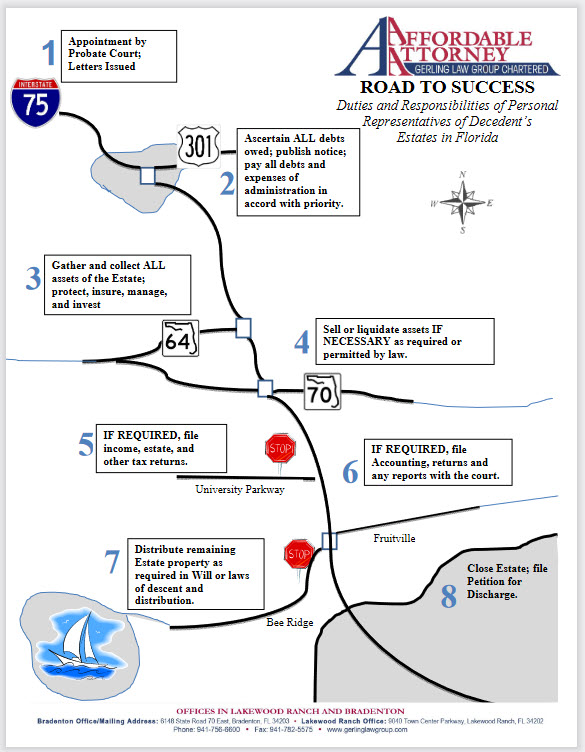

The Probate process is designed to transfer the assets of the decedent to the beneficiaries and satisfy all creditor claims. The Probate process is supervised by the Probate Judge in the county with proper jurisdiction. All documents are filed with the Clerk of Court of that county. The personal representative and attorney do not need to reside in the county of the Probate. The judge will require the estate to be closed within one year unless there are unforeseen issues that arise.

Not all assets of the decedent will pass through Probate. Any asset that was solely owned by the decedent and does not pass upon death or any other operation of law will be subjected to Probate. Examples of assets that would not be subjected to the Florida Probate proceedings are financial accounts jointly held or have a named transfer/payable on death provision, brokerage accounts, retirement accounts, and life insurance (as long as it did not lapse to the estate).

Upon the death of the decedent, a petition for administration must be filed with the Clerk of Court requesting a Probate file be open. The Probate judge must sign an order admitting the will to Probate. If there is no will, then the Florida intestate laws will provide guidance as to how to proceed.

Next, the Probate Judge will sign an order appointing the personal representative of the estate, and issue “Letters of Administration.” The judge may or may not require the personal representative to post a bond. Upon the issuance of the “Letters of Administration,” the personal representative will begin to identify and gather all the assets of the estate. An inventory of the estate assets will need to be filed identifying the assets. The Florida Department of Revenue and Florida Agency for Health Care Administration must be notified of the Probate proceedings.

A notice to creditors must be published in the local newspaper for a period of three months. This is to ensure that all creditors had the chance to come forward and state a claim against the estate. Creditors that do not timely come forward may have their claims barred from recovery. Creditors that have valid claims must be satisfied using the estate assets.

Taxes must be satisfied. The personal representative must file tax returns and satisfy any income or estate tax. The personal representative must defend against any lawsuit against the estate, and pursue any lawsuit for the estate.

After all the proceedings issues have been resolved and all beneficiaries have been identified and noticed, then distribution will occur. An accounting of the estate assets must be filed unless waived by the interested parties. After distributions, a petition for discharge will be filed to close the estate.

Contact us and we will provide you with an affordable fee. You do not need to go through probate on your own.

Probate Roadmap (Click here for full size PDF)

Frequently Asked Questions Regarding Probate Law

What is Probate?

Probate is the Court-supervised process to identify and gather the decedent’s assets, resolve creditor claims, pay taxes, and distribute the funds to the beneficiaries. During Probate the Court acts as a big brother supervising all of the transfer of assets.

Are there different types of Probates?

Yes. Under the Florida Probate statutes, there are both a Formal Administration and Summary Administration. Florida law also establishes a non administration proceeding called “Disposition of Personal Property Without Administration.”

What is the difference between a Formal Administration & a Summary Administration?

Formal Administration is the most commonly used method to Probate an estate in Florida and encompasses more requirements to close an estate. A Summary Administration is an abbreviated method of its counterpart and results in quicker Probate proceedings. A Summary Administration can not be filed if the decedent died within the last two years or if the estate exceeds $75,000.

A personal representative is appointed based on who is named in the decedent’s valid will admitted to Probate and whether that individual(s) qualifies to serve as personal representative, or based on the order of priority based on Florida intestate laws.

How long does the Probate process take?

Every Florida Probate case has different issues that can cause a large variance in how long it takes to close an estate. A good example is a real estate that must be sold before the estate can close, which can take several months. The Probate judge will want the Probate file to close within one year of filing. To give you a perspective of the timing, a notice to creditors must be published for a period of three months. This requirement alone draws the Probate case out for several months.

Why is Probate required?

Probate is needed to finish up the affairs of the decedent and properly retitle the assets to whom they should pass. Probate laws have been in force in Florida since 1845. Florida statutes have default provisions also known as the intestate rules which apply if the decedent dies without leaving a valid will and has property in their sole name. The decedent has the authority to make decisions regarding their property that is in their sole name by leaving a valid will.

Is a Probate required to be filed if the decedent had a will?

Yes. It is a common misconception if the decedent had a will drafted and executed, then their estate would avoid Probate. The fact that the decedent did or did not have a will has no bearing on whether a Probate needs to be filed.

Is an attorney required for all Probate administration in Florida?

Florida law almost always requires an attorney to be involved. Florida Probate Rules 5.030 requires an attorney to represent the Personal Representative/Estate for nearly all Probate matters. An attorney is not required when there is a proceeding with the disposition of personal property without administration. Even with the most basic Probate case, there will be statutory requirements and issues where the Court requires an attorney to be part of the process to assist in advising the personal representative of rights, duties, and obligations they have to the estate and beneficiaries.

What is a Personal Representative?

Many states call this person the Executor however in Florida they are called Personal Representatives. The Personal Representative is the person who will help manage the estate and aid in executing the requirements of the Florida Probate Statutes and Rules. The Personal Representative will identify, gather, value, and safeguard the estate assets and then distribute them at the end of the case.

Who serves as the personal representative?

The will directs whom the decedent prefers to serve as the personal representative, however, they must accept this role and the Probate judge must order their appointment before they legally hold that position. The mere provision in the will that recites who will serve as personal representative is only a preference of the decedent and not binding.

If there is no will, then the Florida Intestacy Statutes to determine who will serve as the personal representative.

What does the Personal Representative do?

There are several tasks required of the personal representative:

- Give notice of the administration of the estate

- Publish a “Notice to Creditors”

- Sign an oath to fulfill the legal requirements for a personal representative

- Post bond

- Search for heirs

- Search for creditors

- Obtain waivers

- File taxes

- Object to invalid claims

- Defend suits against the estate

- Hire professionals to assist in the Probate such as realtors, accountants, financial advisors, appraisers

- Distribute the assets

- Petition to close the estate

Can a Personal Representative receive a fee for serving?

Yes. A personal representative in a Florida estate may receive a fee as set by the Florida Statutes. The personal representative can also waive the fee if they so choose.

If a will states a particular attorney, is this binding on the personal representative?

No, the personal representative can choose the attorney they prefer. The statement will is only a nonbinding request by the decedent.

Are all decedent’s assets subject to Probate?

No. Only assets that were solely in the decedent’s name at their death would be subjected to Florida Probate. Assets that were jointly held, transferable/payable on death, or have the right of survivorship are not subjected to the Probate proceedings.

Who receives the property that was left in decedent’s name if there is no Will?

If there was no will, then the Florida Probate laws of intestacy will determine who will receive the assets of the estate. There are many factors that determine who will take under the Florida intestate statutes which include, if the decedent was survived by a spouse, divorced, minor children, adult children, deceased children with surviving offspring, type of asset, if there is real property involved and if it was homestead property, etc.

Who is involved in the Probate process?

Nearly all Probates will involve the people below. Depending on the issues there could be more people involved.

- Attorney for the Personal Representative

- Personal Representative

- Beneficiaries (spouse, children, siblings, parents, charities, friends)

- Clerk of the Circuit Court

- Circuit Court Judge

- Claimants (people or business claiming the decedent owed them money)

- Florida Department of Revenue

- Internal Revenue Service

- Local Newspaper Publication

What are letters of administration?

This is a document signed by the Probate Judge that appoints the authority to the personal representative to act on behalf of the estate so they can process the Probate. The letters of administration will allow the personal representative to open and close bank or financial accounts in the decedent’s name.

Does someone oversee the Probate Administration?

The local circuit court judge will oversee the Probate administration and they will require that all interested parties be noticed of proceedings involving the Probate. The Probate judge will hear all motions and petitions regarding the estate make the following rulings: accept the will to Probate, appoint the personal representative, issue letters of administration, order determining homestead, order approving the sale of the property, an order striking creditor claims, order posting bond, an order of discharge.

Can a Will be contested and what are common reasons for contesting a Florida Will?

Yes. A will can be contested and litigated for various reasons such as lack of capacity, undue influence, and fraud. Keep in mind that provisions in wills that state it can not be challenged are not enforceable in Florida.

AFFORDABLE ATTORNEY, GERLING LAW GROUP CAN HELP YOU

With over 20 years industry experience Affordable Attorney, Gerling Law is the right law group to help you with all your Legal needs.